Anil Vazirani Scottsdale Investment Advisor shares Retirement confidence plunges on fears of market correction, inflation

October 20, 2021, 10:44 a.m. EDT2 Min Read

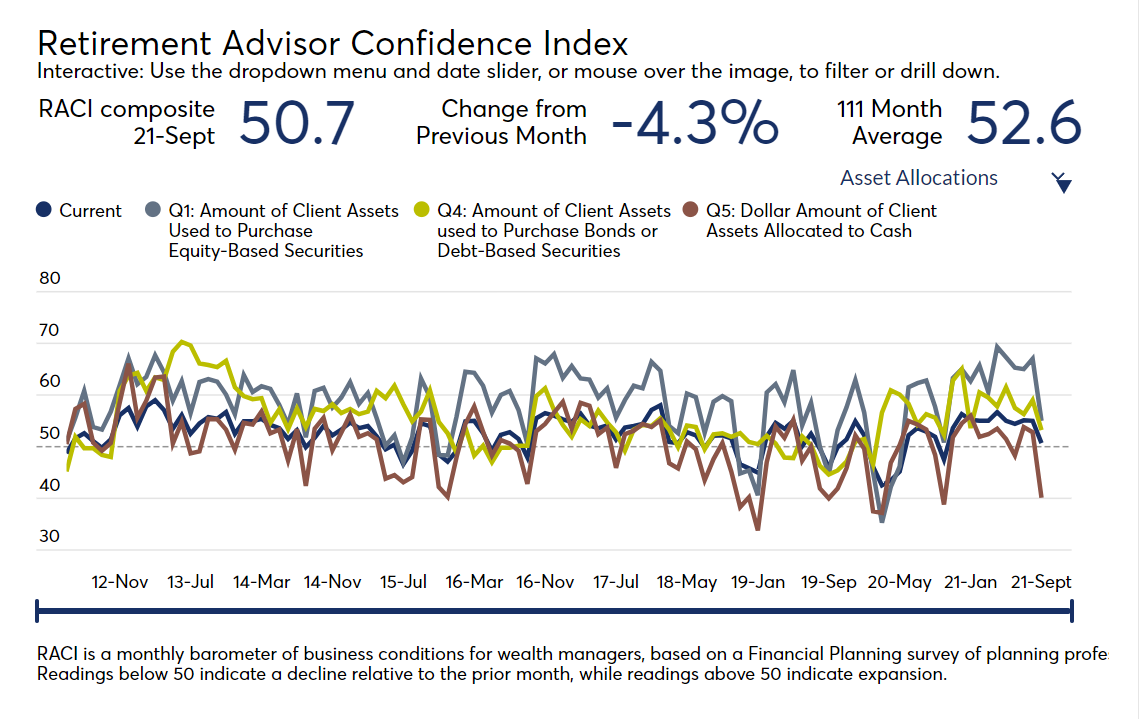

A nervous mix of concerns about market valuations, tax changes and inflation weighed on clients’ confidence about their retirement situation in September, according to the latest Retirement Advisor Confidence Index, Financial Planning’s monthly barometer of business conditions for wealth managers.

“People are getting a little more nervous and somewhat more conservative,” one retirement advisor said.

For the first time in more than a year, there was hardly any mention in advisors’ survey responses of COVID-19, suggesting that advisors have moved on, the anxiety surrounding the pandemic is already baked into clients’ attitudes, or new economic issues are emerging as fresh worries.

Or all three.

“Clients spooked in the second half of September as the markets got choppy,” one advisor said. “But we’re not making major changes at this point.”

That’s hardly a universal view. In aggregate, advisors report a flight from equities as clients grow increasingly nervous about tying their nest egg to the stock market.

The component of RACI that tracks equity allocations posted a score of 55 in September, 12 points down from the previous month and the lowest mark since October 2020. This month’s score was the first time this year that equities checked in with a RACI score below 60.

RACI tallies above 50 indicate an increase in confidence, and scores below that mark signal a decline. So September’s equities score wasn’t disastrous, but the steep drop from the previous period certainly suggested that clients are reevaluating their positions.

September’s composite RACI score checked in at 50.7, which, like equities, came as the lowest mark since last October, and represented a month-to-month drop of 4.3 points. RACI composites had been hovering in the mid-50s throughout 2021, with the previous low mark for the year coming in June at 54.4.

Advisors were mixed in their anecdotal assessments of clients’ appetite for risk, with one reporting that “greed outpaced fear,” despite their warning to clients of “lots of indications that the market is topping.”

But by the numbers, advisors clearly saw their clients pulling back and growing more risk averse. The component of RACI that tracks clients’ risk tolerance tumbled 12.5 points to land underwater at 43, down from 55.5 in August and another low point that hadn’t been seen since last October’s mark of 37.8.

“More clients are beginning to question the market due to inflation fears and people are beginning to get more risk averse,” one advisor said.